- Highlights

- Curriculum

- Global Immersions

- Admissions & Fees

- Career Prospects

- Cohort Profile

PROGRAMME oVERVIEW

Format

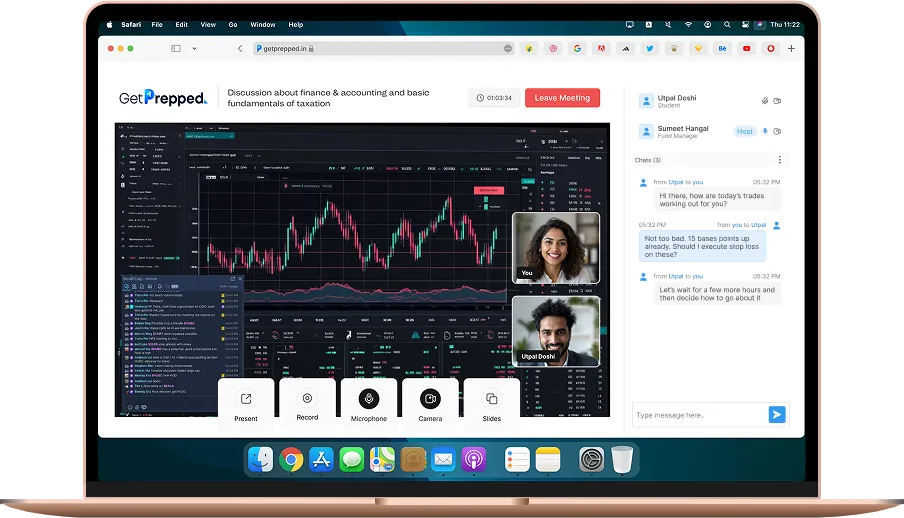

Blended

Online/In-Person Weekend

Classes

Orientation Date

11th Sept '25

Designed For

Investors

Traders, Brokers, Analysts & Asset Managers

Duration

12 Months

Incl. 2 Immersions

Learn 8 Major Financial Instruments

Equity | Debt | Derivatives | Crypto | Forex | Commodities | Real Estate | Hybrid Instruments

Master Modern Trading Tools

MetaTrader 4/5 | R | Python | MATLAB

Exposure to Trading Strategies

Scalping | Day Trading | Swing Trading | Momentum Trading | Mean Reversion

Build Algorithmic Models & Simulations

TWAP | VWAP | Iceberg Orders | Monte Carlo Simulations | Black-Litterman Model

Understand Risk & Compliance

VaR Models | Stress Testing | SEBI | IPA | MiFID II | SEC

Crypto

Real Estate & VC

Risk & Hedging

Commodities & Forex

Derivative Markets

Equity Markets

Equity Markets

Derivative Markets

Commodities & Forex

Risk & Hedging

Real Estate & VC

Crypto

How to Trade Stocks like an Expert

How do markets work and how to master the capital markets ecosystem

How to select the right financial instrument and evaluate investments using risk-return metrics

How to comply with global regulatory standards

How to master the opening bell

How to Safely use Derivatives

How to assess a company's true value

How to get started with futures, options and the greeks

How to hedge risks with covered calls and protective puts

How to protect portfolios using derivatives

How to predict market trends using charts and indicators

How to execute trades with proven day trading strategies

How to Diversify into Commodities & Forex

How to trade commodities and understand pricing mechanisms

How to trade forex pairs and leverage spot, forward and swap markets

How to apply advanced indicators to forex and commodities

How to minimize losses with strategic hedging

How to assess macroeconomic impact on markets

How to apply VPA & Camarilla Pivots

How to ‘Hedge’ Your Portfolios

How to stress-test your portfolio with VaR and Scenario Analysis

How to use exotic derivatives for complex scenarios

How to manage portfolios with dynamic hedging

How to unlock investment opportunities with CDOs and ABS

How to apply volatility metrics in risk management

How to design Stochastic Models for risk assessment and scenario planning

How to Buy Real Estate & Invest in StartUps

How to identify opportunities in REITs

How to diversify portfolios with alternative investments

How to invest sustainably with ESG metrics and green bonds

How to leverage urbanisation and tech-driven trends in real estate

How to overcome cognitive biases for smarter investment decisions

How Not to Lose Money with Crypto

How to master the basics of blockchain and cryptocurrencies

How to trade crypto like a pro: advanced strategies and risk management

How to master bitcoin and ethereum trading

How to analyse global capital flows

How to navigate taxation and risks in global investments

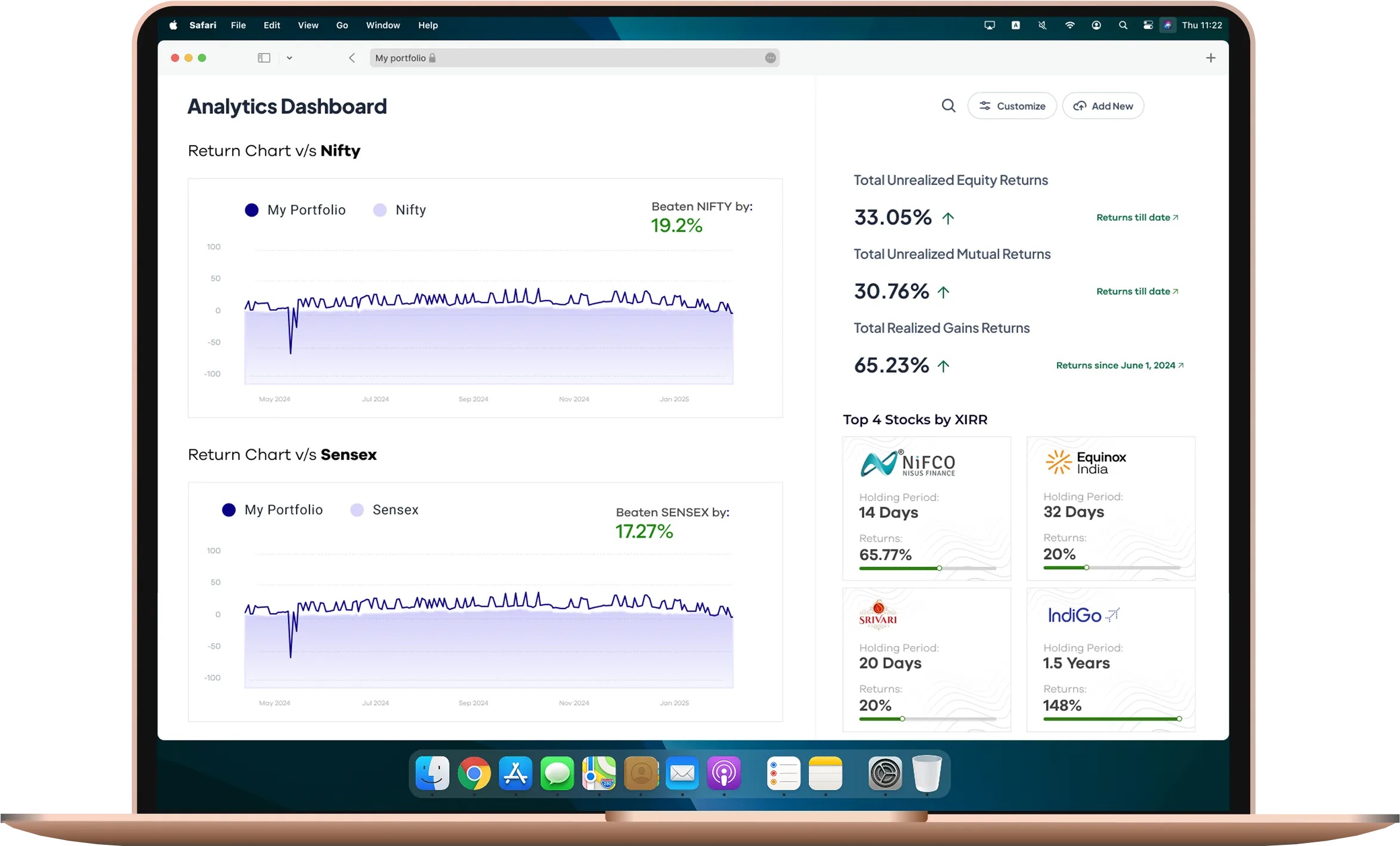

Backed by a ₹40 Lakh fund from Masters’ Union, students actively invest in public markets—making real decisions with real money. Over 3 years, they’ve outperformed both Sensex and Nifty, delivering a 53% realized gain

From compliance to client acquisition, learn how to establish, manage and grow a wealth management firm with a real-world pilot programme

Target to get ₹10 Cr. in AUM within 1 year

Learn how to sell to funds & LPs

Network with & raise capital from HNIs

Get personalized guidance from top mentors and traders empanelled by Masters’ Union

Experts include experienced traders & hedge fund managers

Avoid mistakes & get your portfolios reviewed continuously

Build long-lasting trader relationships beyond the programme

Use financial expertise to create authentic, monetisable content and build a trusted online presence

Publish your own podcast on Youtube & Instagram

Start an expert series on X or LinkedIn

Generate investor interest organically

Backed by a ₹40 Lakh fund from Masters’ Union, students actively invest in public markets—making real decisions with real money. Over 3 years, they’ve outperformed both Sensex and Nifty, delivering a 53% realized gain.

From compliance to client acquisition, learn how to establish, manage and grow a wealth management firm with a real-world pilot program.

Target to get ₹10 Cr. in AUM within 1 year

Learn how to sell to funds & LPs

Network with & raise capital from HNIs

Get personalized guidance from top mentors and traders empanelled by Masters’ Union

Experts include experienced traders & hedge fund managers

Avoid mistakes & get your portfolios reviewed continuously

Build long-lasting trader relationships beyond the program

Use financial expertise to create authentic, monetisable content and build a trusted online presence

Publish your own podcast on Youtube & Instagram

Start an expert series on X or LinkedIn

Generate investor interest organically

Become a part of our deeply engaged trading community consisting of fellow traders, teachers & experts.

Get feedback on trades before executing

Get real-time insights on markets from industry experts

Make faster & more confident decisions on your daily trades

“What are derivatives?”

“How to select stocks?”

“How do I hedge risks ?”

NISM is a SEBI institute that is known for its mandatory

certification exams for mutual fund distributors, research

analysts, etc.

4-weeks immersion at the 72-acre NISM campus, Mumbai

Access to Bloomberg terminals and simulation labs

Government certification on completion of the course

Upstox partners with Masters’ Union to deliver India’s first structured trading education where expert-led learning replaces guesswork.

Courses taught by 20+ real practitioners across instruments

Access to exclusive guest sessions from top hedge fund managers

Engage in live Q&A sessions with renowned economists

1:1 consultation with experts from NSE, Barclays and more

How to assess a company's true value

How to diversify portfolios with alternate investments

How to execute trades with proven day trading strategies

How to evaluate investments using risk-return metrics

How to master the capital markets ecosystem

How to select the right financial instrument

How to leverage private equity & venture capital strategies

How to get started with futures, options, and the greeks

How do capital markets work

How to overcome cognitive biases for smarter investment decisions

How to master debt trading

How to comply with global regulatory standards

How to analyze global capital flows

How to apply volatility metrics in risk management

Disclaimer: *The final list of masters may vary depending on their availability and programme requirements.

A student-managed fund that provides hands-on investment experience across diverse asset classes, including equities, crypto, real estate, and startups.

Watch Video

A student-managed fund that provides hands-on investment

experience across diverse asset classes, including equities,

crypto, real estate, and startups.

The skills to trade like a professional, not a gambler.

Confidence to make trading decisions independently.

Deep understanding of global financial fluctuations.

Skills to build your own fund or a wealth management firm.

Avoiding hearsay & tips from WhatsApp and Telegram channels.

Disclaimer: The Capital Markets Course by Masters’ Union is for educational purposes only and does not provide stock tips, trading calls, or investment recommendations. Any views shared by instructors, speakers, or participants are their own and do not represent Masters’ Union. Participants should do their own research, seek SEBI-registered financial advice, and comply with SEBI regulations before making any financial decisions. Masters’ Union assumes no liability for any financial actions taken.

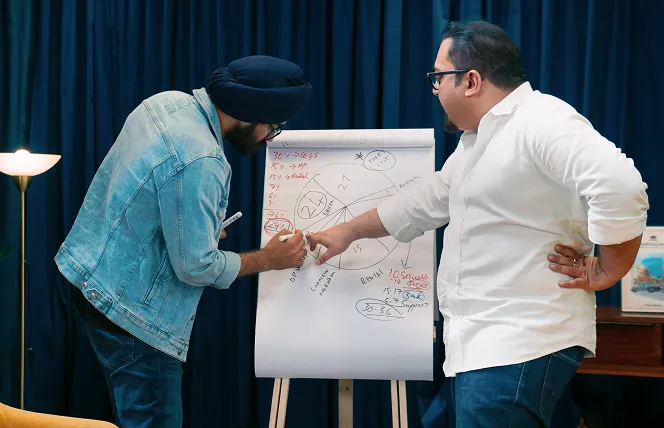

Designed with insights from top traders, economists, and portfolio managers, the curriculum offers hands-on trading exposure. Each term is a combination of InClass learning, OutClass applications, tool-based training, and capstone experiences.

Foundations of Capital Markets

How to Master the Capital Markets Ecosystem

How do Capital Markets Work (Market Mechanisms)

How to Select the Right Financial Instrument

Equity and Derivative Strategy Hackathon with MUIF

MetaTrader 4/5 (MT4/MT5)

Build a Winning Portfolio with Trading Simulation

Equity and Derivative Markets

How to Assess a Company's True Value

How to Get Started with Futures, Options, and the Greeks

How to Hedge Risks with Covered Calls and Protective Puts

Creatorpreneur: Mastering Content Creation in Capital Markets

MetaTrader 4/5 (MT4/MT5)

Analyse Market Reactions to Key Events with Eviews

Commodities and Forex Trading

How to Trade Commodities and Understand Pricing Mechanisms

How to Trade Forex Pairs and Leverage Spot, Forward, and Swap Markets

How to Apply Advanced Indicators to Forex and Commodities

Creatorpreneur: Mastering Content Creation in Capital Markets

MATLAB Computational Finance Suite - MATLAB & Simulink

Build a Commodities and Forex Portfolio Using Simulation

Advanced Risk Management and Derivatives

How to Stress-Test Your Portfolio with VaR and Scenario Analysis

How to Use Exotic Derivatives for Complex Scenarios

How to Manage Portfolios with Dynamic Hedging

Regulatory Compliance and Business Planning

MATLAB Computational Finance Suite - MATLAB & Simulink

Develop Advanced Risk Management and Derivative Strategies

Real Estate and Alternative Investments

How to Identify Opportunities in REITs

How to Diversify Portfolios with Alternate Investments

Client Strategies and Portfolio Management

Python for Financial Data Analysis

Design Sustainable Investment Strategies with ESG Metrics

Cryptocurrency, PEVC and Global Investment Strategy

How to master the Basics of Blockchain and Cryptocurrencies

How to Trade Crypto Like a Pro: Advanced Strategies and Risk Management

WealthPreneur: Build Your Own Wealth Management Firm

Python for Financial Data Analysis

Blockchain and CryptoCurrency Mastery

01.

Complete the

Application

01.

Complete the

Application

Applicants will need to fill out and submit an online application to be considered for the Masters’ Union PGP in Capital Markets & Trading Programme

Requirements:

Personal Details

Professional Details

02.

Online

Interview

02.

Online Interview

If shortlisted, applicants will be invited for an online interview, which will help us get to know them better, and help them understand all aspects of PGP in Capital Markets & Trading. The interview panel will consist of our eminent Masters from academia and the industry, as well as members of the core team.

03.

Final Admission

Decision

03.

Final Admission

Decision

Once the Admissions Office receives feedback from the panel, the application will be re-evaluated and then presented to the Admissions Committee, which makes the final decision for each candidate. Applicants will be advised of the final decision on their application through an email.

The entire admissions process, from the Application Deadline, will take up to 4 weeks.

| Non-Refundable Admission Fee | Tuition Fee | Total Fee Payable |

|---|---|---|

| INR 50,000/- | INR 14,50,000/- | INR 15,00,000/- |

The fee mentioned above is GST-exempt

100%

Maximum merit-based programme fee received by a student.

90+

Scholarships available for the postgraduate batch.

100%

Loan coverage for the programme fee .